|

|

In a world brimming with possibilities, financial success is not solely measured by monetary gains. The modern investor’s quest goes beyond mere profits, embracing a higher purpose: sustainability.

As the global landscape evolves, so do our investment choices. It is no longer sufficient to focus solely on traditional strategies; we must adapt to a new paradigm that encompasses the future we envision.

Here comes diversification – a powerful tool that transcends the boundaries of financial gain and paves the way toward a sustainable portfolio.

From renewable energy to innovative technologies and socially responsible enterprises – below, we uncover the key principles and actionable steps to construct a sustainable portfolio that aligns with your values.

Understanding Diversification

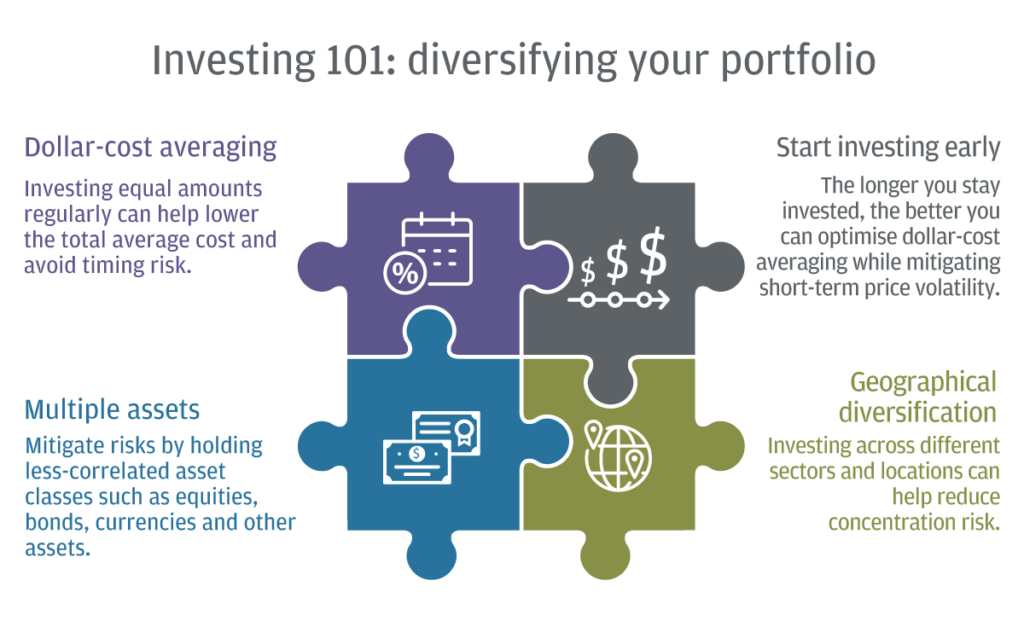

Diversification is a powerful tool that transcends the boundaries of financial gain and paves the way toward a sustainable portfolio. By spreading investments across different assets and sectors, diversification helps mitigate risk and maximize returns.

Traditionally, diversification involved investing in a mix of stocks, bonds, and cash. However, in the pursuit of sustainability, the approach must expand to include sectors and industries aligned with environmental, social, and governance (ESG) factors.

Diversification offers several key benefits for sustainable investing:

- Risk Reduction: By diversifying investments across various assets and sectors, you can reduce the impact of specific risks. If one sector faces challenges, other sectors may still perform well, mitigating potential losses.

- Long-Term Growth Potential: Diversifying into sustainable sectors allows you to tap into long-term growth opportunities. Sustainable industries such as renewable energy and technology have the potential for substantial growth as society shifts toward more environmentally friendly practices.

- Aligning with Values: Diversifying into sustainable investments enables you to align your portfolio with your values. By investing in companies that prioritize environmental responsibility, social equality, and ethical governance, you can support causes that matter to you.

The Shift Towards Sustainability

In recent years, sustainability has gained significant traction in the investment world. Investors are increasingly recognizing that environmental and social issues can have a material impact on a company’s long-term success.

This shift is driven by the realization that sustainable companies tend to outperform their counterparts in the long run. Incorporating ESG factors into investment decisions allows investors to align their portfolios with their values while also potentially achieving superior financial performance.

ESG factors provide a framework for evaluating the sustainability of companies and their impact on society and the environment. Let’s explore the three pillars of ESG:

- Environmental Factors: Environmental considerations assess a company’s impact on the natural world. This includes evaluating its carbon emissions, resource consumption, waste management practices, and efforts to mitigate climate change. Companies that prioritize renewable energy, efficient resource utilization, and environmental conservation often present attractive opportunities for sustainable investors.

- Social Factors: Social factors focus on a company’s impact on people, both within and outside the organization. This includes evaluating labor practices, employee welfare, diversity and inclusion, human rights, community engagement, and consumer protection. Investing in companies that prioritize social responsibility and have a positive impact on their stakeholders can contribute to a more equitable and just society.

- Governance Factors: Governance factors assess a company’s leadership, management practices, transparency, and accountability. It involves evaluating board diversity, executive compensation, shareholder rights, and ethical decision-making processes. Companies with strong governance practices tend to exhibit more responsible behavior and may be better positioned to navigate risks and deliver long-term value to shareholders.

By considering ESG factors, investors can identify companies that prioritize sustainability, responsible practices, and ethical conduct. This holistic approach to investing integrates financial analysis with environmental and social considerations, aligning portfolios with sustainable values and potentially driving positive change.

Unleashing the Potential of Diversification Strategies

To construct a sustainable portfolio, it is crucial to explore sectors and industries that contribute to a more sustainable future. Two key areas that hold immense potential are renewable energy and technology and innovation.

Renewable Energy: Capturing the Future’s Potential

Investing in renewable energy not only helps reduce carbon emissions but also positions investors at the forefront of the energy transition.

Renewable energy sources, such as solar, wind, and hydroelectric power, are experiencing rapid growth and have become increasingly cost-competitive. As governments and corporations worldwide commit to clean energy goals, the sector presents an array of investment opportunities.

- Solar Energy: The solar industry has witnessed significant advancements, making it a compelling investment option. Falling costs, technological breakthroughs, and favorable policies have spurred solar adoption globally. Investing in solar energy companies, solar panel manufacturers, or solar-focused infrastructure funds can provide exposure to this growing sector.

- Wind Energy: Wind power has emerged as a key player in the transition to clean energy. Advancements in turbine technology, coupled with favorable wind resources, have made wind energy increasingly competitive. Investing in wind farm developers, wind turbine manufacturers, or renewable energy infrastructure funds can offer exposure to this thriving sector.

- Hydroelectric Power: Hydroelectric power has long been a reliable source of renewable energy. Large-scale dams and small-scale hydro projects contribute to the generation of clean electricity. Investing in hydropower companies or funds that focus on renewable energy infrastructure can provide exposure to this established sector.

- Other Renewable Energy Sources: Beyond solar, wind, and hydroelectric power, other renewable energy sources, such as geothermal energy and tidal power, are gaining attention. Investing in companies that specialize in these emerging sectors allows investors to support innovation and diversify their sustainable energy portfolio.

Technology and Innovation: Investing in a Sustainable Tomorrow

Technological advancements play a vital role in addressing sustainability challenges. Investing in innovative companies that develop and deploy clean technologies can lead to significant returns while promoting a more sustainable future.

From electric vehicles and energy-efficient solutions to water management systems and waste reduction technologies, the possibilities are vast.

- Electric Vehicles (EVs): The transportation sector is undergoing a transformation with the rise of electric vehicles. Investing in companies involved in EV manufacturing, charging infrastructure, or battery technology can provide exposure to this rapidly expanding market. As governments worldwide incentivize EV adoption and aim for a greener transportation sector, investing in this area can be rewarding.

- Energy Efficiency: Energy-efficient solutions play a crucial role in reducing carbon emissions and optimizing resource utilization. Companies specializing in energy-efficient appliances, smart grid technologies, and building automation systems are well-positioned to benefit from the growing demand for sustainable solutions. Investing in these companies supports the transition to a more energy-efficient future.

- Water Management: Water scarcity is a pressing global issue, making efficient water management crucial. Investing in companies that develop water treatment technologies, water infrastructure, or water conservation solutions can address this challenge while potentially generating attractive returns. Water-related investments offer exposure to an essential resource and contribute to sustainable water management practices.

- Waste Management and Recycling: The circular economy and waste management have gained prominence in the sustainability landscape. Companies engaged in waste recycling, waste-to-energy technologies, or sustainable packaging solutions align with the principles of resource conservation and environmental stewardship. Investing in these areas can support the transition to a more sustainable waste management system.

Socially Responsible Enterprises: Aligning Investments with Positive Impact

In addition to environmental considerations, investing in socially responsible enterprises allows investors to make a positive societal impact.

This involves supporting companies that prioritize fair labor practices, diversity and inclusion, community engagement, and ethical supply chains. By aligning investments with organizations that share the same values, investors can contribute to a more equitable and just society.

- Fair Labor Practices: Companies that uphold fair labor practices, such as providing safe working conditions, fair wages, and workers’ rights, are essential for a sustainable economy. Investing in businesses that prioritize employee well-being and adhere to labor standards can promote positive change.

- Diversity and Inclusion: Diversity and inclusion in the workplace contribute to innovation, creativity, and social progress. Investing in companies that prioritize diversity in their leadership teams, promote equal opportunities, and create inclusive environments supports the advancement of diverse voices and perspectives.

- Community Engagement: Companies that actively engage with local communities and contribute to their development foster positive social change. Investing in businesses that prioritize community engagement, support local initiatives, and have a positive social impact can drive economic growth and improve the well-being of communities.

- Ethical Supply Chains: Companies that maintain ethical supply chains, free from human rights abuses, environmental degradation, and exploitative practices, contribute to a more sustainable and responsible global economy. Investing in businesses that prioritize transparency, accountability, and responsible sourcing supports the eradication of unethical practices.

Constructing a Sustainable Portfolio

Constructing a sustainable portfolio requires a thoughtful approach that balances risk and return. Here are key principles to consider:

1. Identify your Objectives and Values

Define your investment objectives and the sustainability goals you want to achieve. Reflect on the issues that matter most to you, such as climate change, social equality, or corporate governance. Aligning your portfolio with your values ensures a meaningful and impactful investment approach.

2. Select Appropriate Asset Classes and Investment Vehicles

Diversify your portfolio across different asset classes, including equities, bonds, real estate, and alternative investments. Explore sustainable investment vehicles like green bonds, impact funds, and exchange-traded funds (ETFs) that align with your values. These vehicles focus on companies that meet specific ESG criteria, allowing you to invest in a diversified portfolio of sustainable assets.

3. Analyze ESG Factors

Integrate ESG analysis into your investment process. Evaluate companies based on their environmental impact, social responsibility, and governance practices. This analysis helps identify companies with a sustainable business model and potential for long-term growth. Various resources and ratings agencies provide ESG data and analysis to guide investors in their decision-making process.

4. Balance Risk and Return

Diversification is not just about spreading investments but also managing risk. Ensure your portfolio is appropriately diversified across different sectors, regions, and asset types. This helps reduce the impact of market volatility and specific industry risks. Consider the risk-return profile of each investment and strive for a balance that aligns with your risk tolerance and financial goals.

5. Monitor and Adjust

Regularly monitor your portfolio’s performance and stay updated on industry trends and emerging opportunities. Rebalance your portfolio as needed to maintain alignment with your sustainability goals. As the investment landscape evolves, new sustainable sectors may emerge, and existing sectors may undergo shifts. Staying informed and adapting your portfolio ensures you continue to invest in line with your objectives.

Taking Action: Implementing Diversification Strategies

Implementing diversification strategies for sustainable investing requires a systematic approach. Here are steps to guide you:

- Research and Educate Yourself: Gain a thorough understanding of sustainable investing and its various strategies. Familiarize yourself with ESG metrics, industry trends, and the potential risks and rewards associated with different sectors. Educate yourself through reputable sources, research papers, and industry reports.

- Define your Values and Priorities: Clarify your sustainability objectives and the causes you want to support. This will guide your investment decisions and ensure alignment with your values. Consider the ESG factors that matter most to you and prioritize investments that address those issues.

- Seek Guidance from Experts: Consult with financial advisors or sustainable investment specialists who can provide tailored advice based on your goals and risk tolerance. They can help you navigate the complexities of sustainable investing, recommend investment opportunities, and ensure your portfolio aligns with your objectives.

- Conduct Due Diligence: Thoroughly analyze potential investments, considering their financial performance, ESG track record, and alignment with your sustainability criteria. Evaluate companies’ reports, sustainability policies, and industry rankings. Look for transparency and accountability in their practices to ensure they meet your standards.

- Build a Diversified Portfolio: Create a well-balanced portfolio that encompasses various asset classes and sectors. Allocate your investments based on risk tolerance, time horizon, and expected returns. Consider diversifying across sustainable sectors such as renewable energy, technology and innovation, social impact, and other emerging areas that align with your values.

- Monitor and Review: Regularly review the performance of your investments and assess their alignment with your sustainability goals. Monitor ESG data, financial reports, and news related to your investments. Stay informed about industry trends, regulatory changes, and emerging risks or opportunities. Adjust your portfolio as needed to stay on track and take advantage of new sustainable investment prospects.

Conclusion

Constructing a sustainable portfolio goes beyond traditional investment approaches. By embracing diversification strategies that incorporate ESG factors, investors can make a positive impact on the world while potentially achieving superior financial performance.

Investing in renewable energy, technology and innovation, and socially responsible enterprises unlock the power of the future and positions investors at the forefront of a more sustainable and prosperous world.

As we embark on this journey, let us collectively strive for a brighter future and leave a legacy of sustainable growth and positive change. By integrating sustainability into our investment decisions and constructing diversified portfolios, we can contribute to a more equitable, resilient, and sustainable global economy.

Together, we can unlock the power of the future and pave the way for a better world.

No Comments