|

|

In a world fraught with ecological challenges and mounting social concerns, a remarkable revolution has quietly taken hold within the realm of finance.

Welcome to the fascinating domain of sustainable investing!

It’s an irresistible invitation to step into a realm where green is not just a color but a creed, and profit is no longer measured in monetary terms alone.

From boardrooms to bustling streets, a growing cohort of visionary investors is challenging the status quo, forging a pathway toward a world that thrives economically while nurturing the environment and uplifting communities.

Join us as we delve into the realm where finance meets conscience, where innovation meets responsibility, and where profitability converges with purpose. The world of sustainable investing awaits, brimming with opportunities to not just safeguard our planet but to build a brighter, more equitable tomorrow for all.

The Rise of Sustainable Investing

Sustainable investing, also known as responsible investing or socially responsible investing (SRI), has gained significant traction in recent years.

It involves considering environmental, social, and governance (ESG) factors in investment decision-making. The principles of sustainable investing encompass the integration of ESG considerations, active ownership, and impact investments.

Sustainable investing goes beyond financial returns and takes into account the impact of investments on society and the environment. It aims to align financial goals with values and ethics, focusing on long-term sustainability and responsible resource allocation.

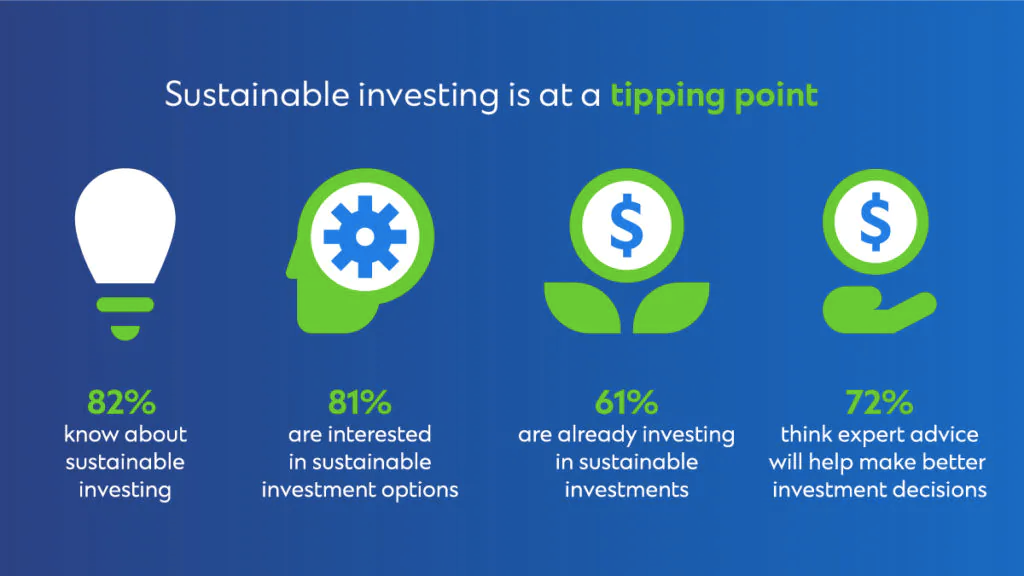

It has transitioned from a niche approach to a mainstream investment strategy and has gained momentum due to increased awareness of global sustainability challenges and a growing demand for purpose-driven investments.

Government regulations and policies play a crucial role in fostering sustainable investing practices. Through measures such as tax incentives, disclosure requirements, and sustainable development goals, governments incentivize investors and businesses to adopt sustainable practices.

Environmental Benefits of Sustainable Investing

Sustainable investing has the potential to drive positive environmental change and address pressing ecological challenges.

- Reducing carbon emissions and combating climate change:

Investments in renewable energy sources, energy efficiency, and low-carbon technologies contribute to the transition to a low-carbon economy. By allocating capital to companies that prioritize emissions reduction and sustainable practices, sustainable investors play a pivotal role in mitigating climate change.

- Preserving natural resources and biodiversity:

Sustainable investing encourages the preservation of natural resources by supporting companies committed to sustainable resource management and conservation efforts. Through responsible investment decisions, investors contribute to the protection of biodiversity and ecosystems.

- Promoting clean and renewable energy sources:

Investors can drive the growth of clean energy industries, such as solar, wind, and hydropower. Financing renewable energy projects accelerates the transition away from fossil fuels and reduces dependence on environmentally harmful energy sources.

- Mitigating environmental risks for companies and investors:

Sustainable investing incorporates environmental risk assessment into investment decisions. By identifying and avoiding companies with significant environmental liabilities, investors mitigate their exposure to financial risks associated with environmental damage and regulatory non-compliance.

Social Benefits of Sustainable Investing

Sustainable investing goes beyond environmental considerations and encompasses social aspects that promote equality, inclusivity, and community development.

- Advancing social equality and inclusion:

Sustainable investing supports companies that prioritize diversity and inclusivity, promoting equal opportunities for all individuals regardless of race, gender, or background. Investing in businesses with strong social impact initiatives contributes to a more equitable society.

- Supporting fair labor practices and human rights:

Investors can play a pivotal role in promoting fair labor practices and human rights by engaging with companies and encouraging responsible supply chain management. By investing in companies that uphold labor rights and respect human dignity, sustainable investors help combat labor exploitation and human rights abuses.

- Investing in education, healthcare, and affordable housing:

Sustainable investing directs capital toward companies and projects that address social challenges such as education, healthcare, and affordable housing. Supporting these sectors may improve societal well-being and the reduction of inequality.

- Strengthening local communities and reducing inequality:

Sustainable investing emphasizes community development and economic empowerment. Through investing in local businesses and supporting community-based initiatives, investors contribute to job creation, economic growth, and poverty alleviation.

Financial Benefits of Sustainable Investing

Contrary to the perception that sustainable investing sacrifices financial returns, numerous studies demonstrate that it can yield competitive financial performance while managing risks effectively.

- Long-term performance and risk management:

Research indicates that sustainable investing can generate favorable long-term returns by identifying companies with sustainable business models and strong governance practices. Companies with robust ESG performance often exhibit better risk management, resilience, and long-term value creation potential.

- Attracting a new generation of investors:

Younger generations, such as millennials and Generation Z, are increasingly drawn to sustainable investing. As these demographic groups inherit wealth and become more influential in the investment landscape, sustainable investing is poised to become a dominant investment approach.

- Enhancing company reputation and brand value:

Companies with strong ESG performance and sustainable practices tend to build better reputations and stronger brands. Positive brand perception can enhance customer loyalty, attract top talent, and bolster a company’s competitive advantage.

- Unlocking innovation and business opportunities:

Sustainable investing drives innovation by channeling capital into companies developing sustainable solutions. These investments spur technological advancements, create new markets, and unlock business opportunities that align with the evolving needs of a sustainable future.

Challenges and Limitations of Sustainable Investing

While sustainable investing has experienced remarkable growth, it faces several challenges and limitations that require attention and proactive solutions.

- Lack of standardized metrics and reporting:

The absence of consistent ESG metrics and reporting frameworks poses challenges for investors in assessing and comparing companies’ sustainability performance. Standardized reporting guidelines and increased transparency are necessary to facilitate informed investment decisions.

- Greenwashing and the need for transparency:

Greenwashing, where companies exaggerate or misrepresent their environmental credentials, poses a significant risk to sustainable investing. Investors need transparency and independent verification of sustainability claims to ensure the authenticity of their investments.

- Balancing financial returns and impact goals:

Sustainable investing aims to achieve both financial returns and positive impact. However, striking the right balance between financial objectives and impact goals can be challenging. Investors must navigate this balance while remaining true to their sustainability commitments.

- Addressing the complexity of global sustainability issues:

Global sustainability challenges, such as climate change, poverty, and inequality, are complex and interconnected. Addressing these issues requires collaboration, systemic change, and a multifaceted approach. Sustainable investing alone cannot solve all these challenges, but it can be a catalyst for change.

How Individuals Can Get Involved in Sustainable Investing

Individual investors have the power to contribute to sustainable development and drive positive change through their investment choices.

- Investing in sustainable funds and portfolios:

Individuals can allocate their investments to sustainable funds and portfolios that prioritize ESG factors and align with their values. These funds provide diversified exposure to companies with strong sustainability performance.

Green bonds are fixed-income instruments issued to finance environmentally friendly projects, such as renewable energy, energy efficiency, and clean transportation. By investing in green bonds, individuals can directly support projects with positive environmental impact.

Similarly, sustainability-themed funds focus on companies that prioritize sustainable practices across various sectors, providing individuals with a diversified investment option aligned with their values.

- Engaging with companies as responsible shareholders:

Shareholders can engage with companies through proxy voting, shareholder resolutions, and dialogue. This active ownership approach allows investors to influence corporate practices and advocate for sustainable business strategies.

Individuals who own shares in publicly traded companies have the opportunity to engage in shareholder activism. This involves actively participating in annual general meetings, voting on important resolutions, and engaging in dialogue with company management.

Shareholder activism allows individuals to advocate for sustainable practices, transparency, and improved ESG performance within companies.

- Supporting sustainable entrepreneurs and startups:

Investing in sustainable startups and entrepreneurs fosters innovation and accelerates the development of sustainable solutions.

Platforms and networks exist to connect investors with impact-driven startups seeking funding.

- Advocating for sustainable investment practices and policies:

Individuals can contribute to the wider adoption of sustainable investment practices by advocating for policy changes and raising awareness about the benefits of sustainable investing.

They can engage with policymakers, financial institutions, and communities to drive positive change.

- Divesting from fossil fuels and high carbon industries:

Divestment involves withdrawing investments from companies involved in fossil fuel extraction, high carbon emissions, or environmentally damaging practices.

By divesting from such industries, individuals send a strong signal to the market and contribute to the transition toward a low-carbon economy.

Divestment campaigns have gained momentum globally, with individuals, universities, and institutions divesting billions of dollars from fossil fuel-related investments.

- Community investing and impact investing:

Community investing involves directing investments toward underserved communities, often through community development financial institutions (CDFIs) or microfinance institutions.

Individuals can support affordable housing initiatives, small businesses, and social enterprises in marginalized areas, helping to address economic inequality and promote inclusive growth.

Impact investing focuses on generating measurable social and environmental impact alongside financial returns. By investing in impact funds or directly in social enterprises, individuals can support innovative solutions to pressing global challenges.

- Educating oneself and seeking professional guidance:

Sustainable investing is a dynamic and evolving field. Individuals can invest time and effort in educating themselves about ESG factors, impact measurement, and sustainable investment strategies.

There are numerous resources available, including online courses, books, webinars, and conferences.

Seeking guidance from sustainable investment professionals, financial advisors, or wealth managers who specialize in sustainable investing can provide valuable insights and help individuals align their investment goals with their values.

- Joining sustainable investing networks and organizations:

There are various networks and organizations dedicated to promoting sustainable investing.

Joining these networks allows individuals to connect with like-minded individuals, share experiences, and stay informed about the latest developments in sustainable investing.

These networks often organize events, webinars, and workshops that provide opportunities for learning, networking, and collaboration.

Examples of ESG Funds

We mentioned above that individuals can invest in sustainable funds and portfolios to align their financial goals with their values. Here are some examples of ESG funds that focus on companies with strong environmental, social, and governance performance.

iShares MSCI Global Sustainable Developmental Goals ETF (SDG)

This exchange-traded fund (ETF) seeks to track the investment results of an index composed of global equities that exhibit strong alignment with the United Nations Sustainable Development Goals (SDGs).

The fund invests in companies that demonstrate a positive impact on society and the environment while maintaining robust ESG performance.

Parnassus Core Equity Fund (PRBLX)

The Parnassus Core Equity Fund is a US-based mutual fund that aims to provide long-term capital growth while incorporating ESG criteria into its investment process.

The fund focuses on high-quality, large-cap companies with strong competitive positions, sustainable business practices, and attractive valuations.

Calvert US Mid Cap Core Responsible Index Fund (CMJAX)

This mutual fund seeks long-term capital appreciation by investing in mid-cap U.S. companies that demonstrate strong ESG performance.

The Calvert US Mid Cap Core Responsible Index Fund evaluates companies based on their environmental impact, social practices (e.g., gender equality), and governance policies, selecting those with the potential for sustainable growth and competitive advantage.

Vanguard ESG U.S. Stock ETF (ESGV)

The Vanguard ESG U.S. Stock ETF is an exchange-traded fund that aims to track the performance of a benchmark index that measures the investment return of U.S. stocks with positive environmental, social, and corporate governance (ESG) characteristics.

The fund invests in companies that meet high ESG standards across various sectors, providing investors with diversified exposure to responsible investments.

The Vanguard ETF is known for its diversified portfolio, with nearly 1500 holdings in various sectors.

It’s interesting to note that the Vanguard ETF abstains from purchasing stocks in certain industries, ranging from tobacco and alcohol to weapons manufacturing and fossil fuel production.

Conclusion: Building a Sustainable Future Through Investing

Sustainable investing offers a powerful pathway to address global challenges and build a sustainable future for generations to come.

By integrating environmental, social, and governance considerations into investment decisions, sustainable investors can generate both financial returns and positive impacts. The transformative power of finance, when harnessed responsibly, has the potential to shape a better world.

Embracing the challenge and opportunity to invest in a sustainable future allows us to safeguard our planet, foster social equity, and build a brighter, more equitable tomorrow for all.

The world of sustainable investing awaits, brimming with opportunities to invest in a future that thrives economically while nurturing the environment and uplifting communities. Together, let us embark on this journey toward a sustainable and prosperous world.

No Comments