|

|

Our world is going through some big changes. People are starting to care more about caring for our planet, treating everyone fairly, and doing business correctly. These important ideas have a name: ESG, which stands for environmental, social, and governance. Let’s explore why ESG matters so much in today’s world.

What is ESG and the ESG Movement?

ESG, which stands for Environmental, Social, and Governance, is a set of important criteria for judging a company’s performance in three key areas. These areas are the environment, how it treats people, and how it’s run. Let’s examine what ESG means and why it matters today.

ESG: Breaking It Down

Image Credit: Naem.org

Imagine you have a report card for a company, like the report card you get in school. This report card, called ESG, checks three essential things:

1. Environmental: When discussing environmental factors, we examine how a company affects the world around us. This includes things like how much greenhouse gas they release, how they take care of nature, and how ready they are to handle problems caused by climate change, like floods and fires.

This is about how the company treats the planet. It’s like asking, “Is the company caring for nature?” For example, is it using clean energy, reducing waste, and not polluting the air or water?

2. Social: The social side of ESG is all about how a company treats people and communities. It’s not just about how they treat their employees but also how they affect their workplaces. For example, do they pay fair wages and make sure their workers are happy? ESG also cares about the people in their supply chains, especially in countries where environmental and labor rules might not be so strong.

This part is all about people. It’s like asking, “Is the company treating everyone fairly and kindly?” This includes employees, customers, and people in the company’s communities. Are workers paid well and treated with respect? Does the company give back to the community?

3. Governance: Corporate governance is like a company’s rulebook. ESG experts want to know if the company’s leaders follow the rules and do what’s suitable for everyone. They check if the leaders’ goals match what the company’s owners want, if the owners have a say in things, and if there are clear rules to ensure everyone is honest and open.

Think of governance as the rules and leadership in the company. It’s like asking, “Is the company following the rules and being honest?” Good governance means leaders are transparent and accountable and make decisions that benefit everyone, not just a few.

Why Is ESG So Important Now?

The importance of ESG (Environmental, Social, and Governance) is on the rise, and there are compelling reasons behind its growing significance:

Addressing Global Challenges: Our planet is grappling with critical challenges, such as climate change and the depletion of vital resources. These concerns have raised alarms worldwide, increasing expectations that companies actively contribute to solving these global issues.

Embracing Long-Term Vision: It’s no longer just about short-term profits. People have realized that for a company to succeed over the long haul, it must also be a force for good. ESG principles guide businesses toward sustainability, ensuring they survive and thrive for future generations.

Examples of ESG in Action

Let’s explore how ESG principles come to life through concrete examples:

Environmental: Consider a company like Tesla, renowned for its electric cars. Tesla’s commitment to sustainable transportation helps reduce air pollution and combat climate change. By manufacturing electric vehicles, they contribute to a cleaner and healthier environment.

Social: Starbucks is another prime example of ESG in action. They have published yearly updates on their performance related to Environmental, Social, and Governance (ESG) factors since 2001. Starting in 2021, Starbucks is committed to integrating SASB ESG reporting standards into its annual Global Environmental and Social Impact Report.

The coffee giant is well-known for its employee-friendly policies, including health insurance and educational support. Starbucks is dedicated to transparent third-party audits and ongoing disclosures of its global social and environmental impact. Moreover, Starbucks actively supports coffee farmers globally, ensuring fair wages and ethical farming practices. This demonstrates their commitment to social responsibility and community well-being.

Governance: Apple Inc. sets the bar high in terms of governance practices. The company’s transparent financial reporting and ethical leadership earn the trust and confidence of shareholders and investors. Apple’s commitment to strong corporate governance ensures accountability, transparency, and responsible decision-making.

These real-world instances highlight the practical application of ESG principles. The ESG movement isn’t solely about profit; it’s about businesses positively impacting the world, addressing environmental, social, and governance concerns while prospering in the process.

ESG Investing: A New Approach to Sustainability

How does ESG investing differ from traditional investing?

ESG investing differs from conventional investing by integrating ESG factors into investment decisions. While traditional investing mainly focuses on financial returns, ESG investing considers broader considerations, including a company’s social and environmental impact. It aims to generate sustainable financial returns while also promoting positive change.

What are the critical factors considered in ESG investing?

ESG investing considers various factors, including a company’s carbon emissions, diversity and inclusivity, labor practices, product safety, and supply chain management. These factors provide insights into a company’s sustainability and ethical practices, guiding investment decisions based on long-term value creation.

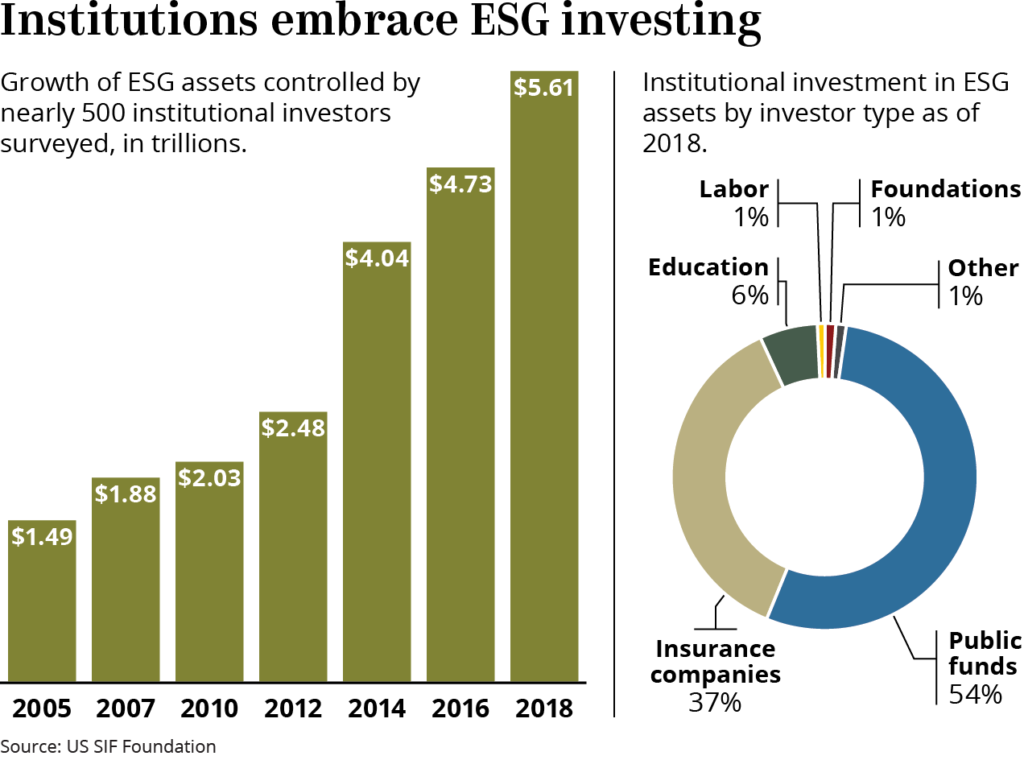

Exploring the growth of ESG funds

In recent years, there has been a significant growth in ESG funds. These funds specifically allocate capital to companies with strong ESG performance. According to Morningstar, global sustainable funds attracted nearly $1.7 trillion in assets under management by the end of 2020, reflecting the increasing interest in ESG investing.

The Role of Governance in the ESG Movement

ESG investing is not your typical way of investing money. It’s a bit different, and here’s why:

ESG vs. Traditional Investing

In traditional investing, the main focus is on making money. People invest their money to get more money back, and that’s about it. But ESG investing adds something extra to the mix.

ESG Considers the Bigger Picture

ESG, which stands for Environmental, Social, and Governance, looks at the bigger picture. Yes, it’s still about making money, but it’s also about positively impacting the world. So, it asks, “Is this company making money in a way that’s good for the environment and people?”

Key Factors in ESG Investing

When ESG investors decide where to put their money, they look at a few critical things:

- Carbon Emissions: This means how much pollution a company creates. Companies that pollute a lot may not be suitable for the environment, and that’s not good for the long term.

- Diversity and Inclusivity: ESG investors want to see a mix of people working at a company. When a company has workers from different backgrounds, it often means they have different perspectives, which can be good for business.

- Labor Practices: This is about how a company treats its workers. ESG investors like companies that treat employees fairly pay them well, and keep them safe at work.

- Product Safety: Nobody wants to buy dangerous products. ESG investors check to ensure companies sell things that won’t harm people.

- Supply Chain Management: ESG investors look at how companies get their materials and make their products. They want to ensure it’s done in a way that’s good for the environment and fair to the people involved.

The Challenges and Opportunities in ESG

Some people have doubts about the ESG movement, so looking at them closely is essential.

Addressing the criticisms of the ESG movement

The ESG movement has faced criticisms, including concerns about greenwashing, which refers to companies making false or exaggerated claims about their ESG practices. To address these criticisms, developing robust ESG standards and regulations is crucial to ensure the credibility and integrity of the ESG movement.

Exploring the potential financial returns of ESG investing

Contrary to the misconception that ESG investing sacrifices financial returns, evidence suggests that companies with strong ESG performance often outperform their peers in the long run. Many studies have shown a positive correlation between strong ESG practices and financial performance, indicating potential financial returns in ESG investing.

The role of financial services in driving ESG adoption

Financial services, including asset managers and pension funds, play a significant role in driving ESG adoption. By integrating ESG considerations into their investment strategies, these institutions influence companies to prioritize ESG factors. The demand for ESG investments from institutional investors further accelerates the integration of ESG into the mainstream investing landscape.

Looking Ahead: The Future of ESG

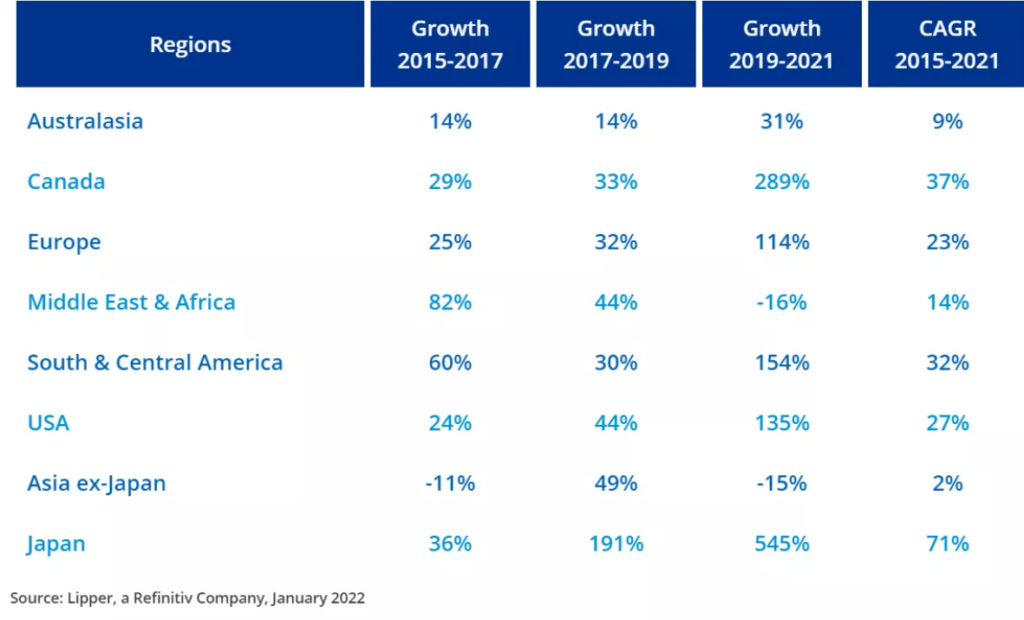

Predicting the impact of ESG in 2022 and beyond

The impact of ESG is expected to continue growing in 2022 and beyond. As more companies recognize the importance of ESG, we can anticipate increased adoption of sustainable practices, better governance standards, and a greater focus on social and environmental factors. ESG will become a driving force for positive change across various industries.

The role of stakeholders in shaping the future of ESG

Stakeholders, including investors, consumers, employees, and regulators, will play a pivotal role in shaping the future of ESG. Their increasing demand for sustainable and responsible practices will drive companies to embrace ESG as a strategic imperative, leading to a more sustainable and equitable business landscape.

The importance of continued innovation in ESG metrics

Continued innovation in ESG metrics is essential to enhance the effectiveness of ESG assessment and reporting. As the ESG landscape evolves, new metrics and frameworks will be developed to capture a broader range of ESG factors and provide more accurate insights into a company’s sustainability performance.

Frequently Asked Questions

ESG stands for Environmental, Social, and Governance. It is a framework to evaluate a company’s sustainability and ethical practices.

The ESG movement refers to the growing focus on sustainability and social responsibility in business and investing practices.

The ESG movement drives businesses to adopt sustainable practices, improve social and environmental outcomes, and enhance corporate governance.

ESG criteria are the factors used to assess a company’s environmental, social, and governance performance. These criteria vary among rating agencies and investors.

ESG funds are investment funds that prioritize companies with substantial environmental, social, and governance practices.

The anti-ESG movement is a group that opposes the ideas and principles of ESG, arguing that it hinders economic growth and shareholder value.

ESG standards are the guidelines and benchmarks used to evaluate and compare companies’ ESG performance.

ESG rating agencies are organizations that assess and rate the ESG performance of companies. They provide investors with data and analysis to make informed decisions.

A: ESG disclosure refers to companies openly sharing information about their environmental, social, and governance performance.

A: Rating agencies play a critical role in ESG investing by objectively assessing companies’ ESG performance, which helps investors make informed decisions.

Conclusion

In conclusion, our exploration of the ESG (Environmental, Social, and Governance) movement reveals its profound global impact. ESG highlights the need to consider environmental, social, and governance factors in decision-making, promoting ethical and sustainable practices alongside financial success.

Governance, a core ESG element, ensures accountability and transparency within organizations and through government policies. The ESG movement’s influence on business practices and investments is growing, emphasizing responsible behaviour.

ESG aligns profit with planetary and societal well-being, addressing global challenges through collective action. Environmental stewardship, social responsibility, and effective governance are now essential, guiding us toward a world where profit coexists with purpose and commitment.