Designed for “a new generation”, the Long Term Stock Exchange (LTSE) is a platform that enables companies to focus on sustainable, long-term business practices.

Busy? Try the speed read.

The scoop A new stock exchange was approved by the SEC in 2019. It focuses on long-term sustainability. We thought it demanded more PR.

Things to know

- 87% of executives and directors feel most pressured to demonstrate strong financial performance within two years.

- If all US companies had employed long-term strategies, they would have added

- $1 trillion to U.S. GDP

- Five million jobs between 2001 and 2015

- Economic earnings for long-term firms grew on average 81% more than other firms.

The Long Term Stock Exchange was founded by Eric Ries after an international tour for his NYT best-seller Lean Startup. The innovative stock exchange uses principles-based listing standards for new companies with an emphasis on long-term environmental, social and governance goals.

Bottom line In a time in which we face unprecedented and urgent long-term problems such as climate change, racial injustice, and the threat of epidemics, it is crucial that our institutional infrastructure supports the long-term solutions needed to tackle such complex problems.

Dig deeper → 4 min

While a global pandemic shakes the economy, another epidemic is brewing in financial markets (and the C-suites of many companies) – it’s called short-termism.

McKinsey found that 87% of executives and directors feel most pressured to demonstrate strong financial performance within two years.

Short-termism, though helpful sometimes, suffocates our financial system when overused. And we are overusing it so much, that we need to reevaluate business practices that reinforce this belief system.

In comes Eric Ries with his bold antidote to the old world’s obsession with financial quarters. Meet the Long Term Stock Exchange.

How the Long Term Stock Exchange updates financial frameworks

Eric Ries went on an international tour for his New York Times bestseller The Lean Startup nine years ago. During that trip, Ries met countless executives and middle managers. Time and time again, business leaders reported short-termism as one of the top three problems facing their companies.

Short-termism focuses on short-term results at the expense of long-term goals. In most instances, businesses act with a short-term mindset to satisfy earnings expectations ahead of each financial quarter. Imagine you face regular pressure from shareholders, continuous media scrutiny of market conditions, and short-term incentives. For some companies, thinking big picture is near impossible.

Based on Ries’ experience, managers from diverse backgrounds consistently lamented this issue. It revealed how the short-sighted epidemic sits deep at the core of our financial monoliths, most notably stock exchanges.

Eric’s idea: Let’s create a new stock exchange that alleviates short-term pressures. The LTSE aligns long-term investors with long-term companies. Get the resources you need “to innovate, invest in your employees, and seed future growth,” he says.

It’s an audacious concept, and established Institutions are his new competitors.

For context, the NASDAQ (49 years old) and New York Stock Exchange (228 years old) have a cumulative market cap of $11.1 trillion and $28.5 trillion as of September 2019.

Even with the barrier to entry, the LTSE gained approval from the SEC in May 2019. Will the LTSE forge the path for a new era of company-investor relations?

Long Term Stock Exchange’s differentiator

5 principles-based listing standards

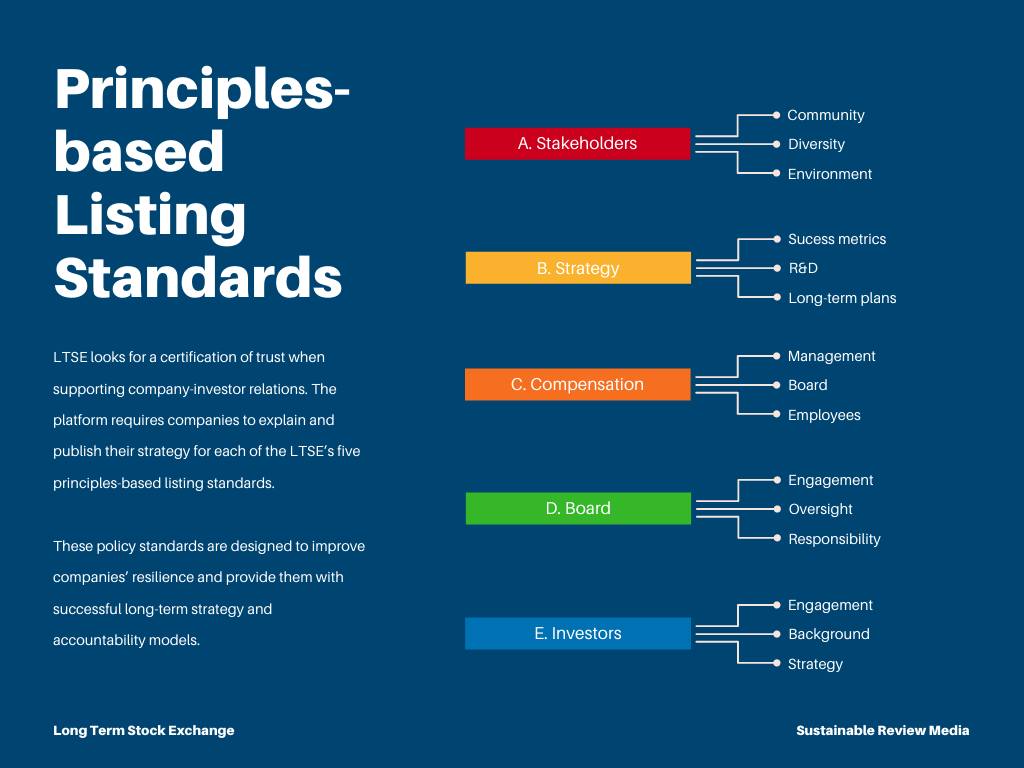

One of the LTSE’s main strategies to support company-investor relations is to act as a certification of trust for investors. The platform requires companies to explain and publish their strategy for each of the LTSE’s five principles-based listing standards.

These policy standards are designed to improve companies’ resilience and provide them with successful long-term strategy and accountability models. Refer to this Detailed White Paper for the research behind each policy.

Let’s dive into the five principles-based listing standards:

- Stakeholder Policy: identify stakeholders that are critical to long-term success, explain the impact on each stakeholder and approaches to community, diversity, and the environment

- Strategy Policy: measure success in years and decades, adding time horizons to the company’s strategic plans, success metrics, prioritization implementation, and long-term R&D

- Compensation Policy: align management and board compensation with long-term performance

- Board Policy: engage the board of directors in the long-term policies and give them oversight and responsibility

- Investor Policy: explain how the company engages with long-term investors

The policies provide a unique accountability framework and incentives for executives and boards to stick to their long-term strategies, rather than give in to short-term pressures.

There is a binding commitment to protect stakeholders. Whether the stock price is up or down, companies can start building a trustworthy reputation.

It is also important to note, that the exchange itself is incentivized to support the long-term success of the companies it lists. LTSE sources the bulk of its revenue not from trading and the sale of data, but rather from the sale of software.

This software can help companies with operationalizing long-term strategies and distinguishing long-term investors.

Short-termism hinders companies from achieving full potential

The LTSE warns that short-termism “creates risk for companies, their shareholders and other stakeholders, and societies.”

Though, caring about short-term goals is not a problem in itself. It becomes problematic when long-term goals are compromised as a result.

For example, companies suffering from short-termism might:

- Cancel long-term R&D investments in financially difficult quarters

- Buy back shares rather than build cash reserves

- Underpay and under-hire

- Lack an adequate environmental policy

Moreover, short-termism comes with real costs. The looming pressures of short-termism in public markets (and the antiquated IPO process) cause companies to go public late, if at all. This hurts mostly retail investors. These investors, without the means to invest in the private sector, miss out on early stage growth.

Additionally, the McKinsey study on the economic impact of short-termism notes that if all US companies had employed long-term strategies, they would have added $1 trillion to U.S. GDP and an additional five million jobs between 2001 and 2015.

This estimate is supported by findings that economic earnings for long-term firms grew on average 81% more than other firms. Economic earnings measure the difference between revenues and all costs including opportunity costs.

According to the study, these firms also spent 50% more on R&D and increased their R&D spending throughout the financial crisis, a period in which many companies succumb to short-term market pressures.

An inspiration to future generations

There are many potential economic and societal benefits of an economy filled with long-term companies. The advantages may even extend well beyond the companies themselves.

The new stock exchange provides hope that shifting business strategy can influence stakeholders, politicians, and communities to realign their value systems.

Let’s inspire a new generation of civic entrepreneurs.

In an era faced with unprecedented and urgent long-term issues like climate change, racial injustice, and threat of pandemic, it is crucial that institutional infrastructure supports the long-term solutions needed to tackle such complex problems.

As Ries says himself “we do not have to take the institutions of our generation as a given, we can build new and better ones.”

You can learn more about the Long Term Stock Exchange on their website here.

No Comments