|

|

If you want to decarbonize the economy, carbon offsets don’t work. Here’s why.

Despite doubling in price the last 18 months, carbon offset prices are cheap (relative to the cost of reducing emissions). Carbon offsets should and will be much more expensive. For now, because they’re so cheap, carbon credits act more like a marketing tool than a social good.

The little secret?

Dig deeper → 3 min

You can purchase and stake carbon credits through several emerging digital coins (more on that below). By purchasing coins backed by carbon credits, you inevitably raise the cost of offsetting carbon. And by raising its value, you can force companies to hold themselves accountable for carbon pledges, even when it may not be profitable.

What are carbon offsets?

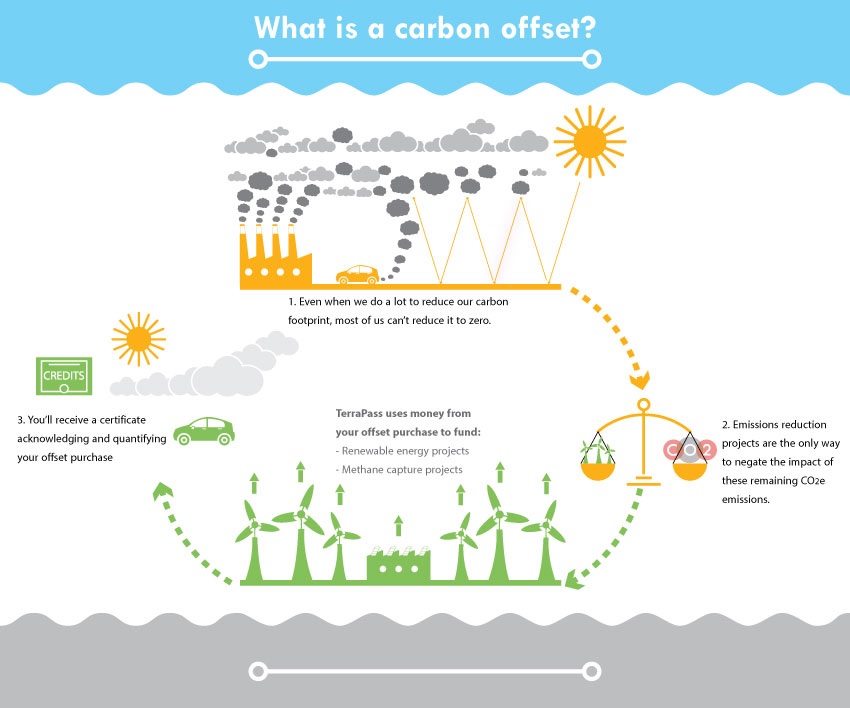

Carbon offsets are a method for companies and governments to “offset” their emission outputs by purchasing credits that contribute to carbon positive efforts. That includes preserving wildlife populations, reforesting sensitive areas, restoring damaged ecologies, etc.

Most forms of corporate carbon offsets exist on the voluntary carbon market, where companies choose to mitigate their emissions on good-faith (excluding social capital).

In voluntary carbon markets, on the other hand, are reserved for corporations and governments that are required to stay below a carbon threshold, whether it be mandated via international treaty or local regulation.

Why companies make carbon pledges

Ever watch a commercial recently with a multinational company like Apple, Amazon, Nike, your local utility provider—boasting carbon neutrality by 2030?

Most companies make carbon pledges because in the short term they can purchase offsets to mitigate current emissions. They can worry about internal operations later.

Global companies like Apple can talk about ramping down emissions in quarterly board meetings while buying themselves time through voluntary carbon.

If Apple still breaks even on its CO2 output, what difference does it make?

Carbon offsets don’t work because if every company chose that method, there wouldn’t be enough credits to go around and hit 2030 goals. Even if there were enough credits, researchers suggest that offset markets are not sufficient to decarbonize the global economy anyway.

Carbon credit prices will explode

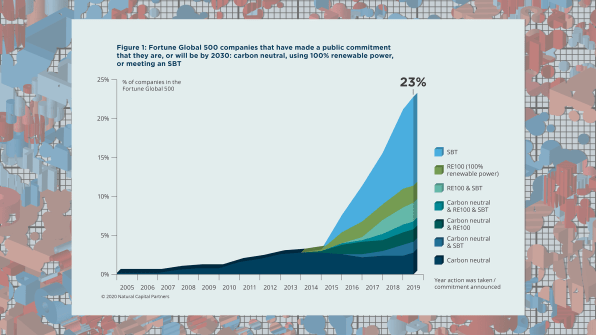

As of February 2020, about a quarter of Fortune Global 500 companies made public commitment to be carbon neutral by 2030 (if they aren’t already). That number is likely much higher today.

In 5-10 years, all these companies relying on carbon offsets will start competing with one another to hit their goals. The result? Carbon credit prices will likely jump.

GreenBiz estimates that carbon offset prices are set to increase tenfold by 2030. The price has already jumped nearly 3x since writing that article last year.

There is a surplus of carbon credits that keep corporations complacent about their emissions… but that will soon fade. In the long run, it will be cheaper to remove emissions than to rely on offsets. And industry disruptors are coming in to manifest that reality.

How to stake carbon and pressure bad actors

One algo-based stablecoin called Klima DAO is exposing why carbon offsets don’t work. Their mission is to drive up the cost of voluntary carbon, and create so much value that corporations must back their claims.

Here’s an interview about how crypto can be good for the environment along with an explanation of Klima.

Klima (and other digital carbon credit coins like UPCO2) want to democratize an asset class that is otherwise gatekept by governments and corporations. By opening the retail floodgates through defi and blockchains, voluntary carbon offset markets are even more likely to appreciate in value.

For crypto newbies interested in purchasing carbon credits, I’d recommend starting with Uphold since you can tie it directly to your bank account. Klima is a bit more tech-intensive (albeit more powerful) and requires a digital wallet containing ETH.

Carbon offsets won’t work in the future

The next ten years will determine the future of CO2 emissions.

High polluters will face institutional pressure to dampen emissions. Medium-to-low actors will be forced to dampen emissions internally, purchase overly-expensive voluntary carbon, or face social pressure and consumer demand.

Carbon offsets don’t work on their own. And they delay the impact of legacy companies with deep pockets that can afford credits but are hesitant to update operations.

At one time, carbon offsets had a real opportunity to promote high-impact conservation efforts. But with loose regulations, companies have used them more as a pushback to ease public pressure. Time will tell how long they can stack this house of cards.

No Comments