|

|

Last month, a crypto wallet company called Uphold launched a digital carbon credit coin. It’s called the Universal Carbon token (UPCO2).

UPCO2 is one of the first carbon credit coins available to everyday investors. As part of its mission, UPCO2 tokens link to carbon trading markets, an industry typically dominated by governments and corporations.

Busy? Try the speed read.

The scoop: Uphold, a digital trading platform, released a digital carbon credit coin called UPCO2.

On a mission to democratize carbon: Think of corporations and governments as the gatekeepers of carbon credit markets. Using blockchain technology, UPCO2 hopes to ease the barrier to entry for ordinary people. UPCO2 can also help standardize carbon prices on a global level using voluntary carbon credits (VCUs).

Should you buy one? UPCO2 coins help reforestation efforts in areas like the Amazon, Congo Basin, and Indonesia. Carbon prices (like any commodity) are pretty volatile, but I predict durable demand for this asset. Every day people want more ways to take climate action. This is one.

Dig deeper → 4 min

The Universal Protocol Alliance (UPA), a network of prominent blockchain and cryptocurrency companies, partnered with digital gold trader InfiniGold, crypto hardware builder Ledger, and trading platform Uphold to launch the innovative asset.

The hope is to 1) democratize a new asset class (carbon) and 2) initiate a carbon global clearing price similar to other commodities like oil and gold.

As more people trade carbon coins, the UPA also expects an increase in resources allocated to environment-related projects.

How does UPCO2 work?

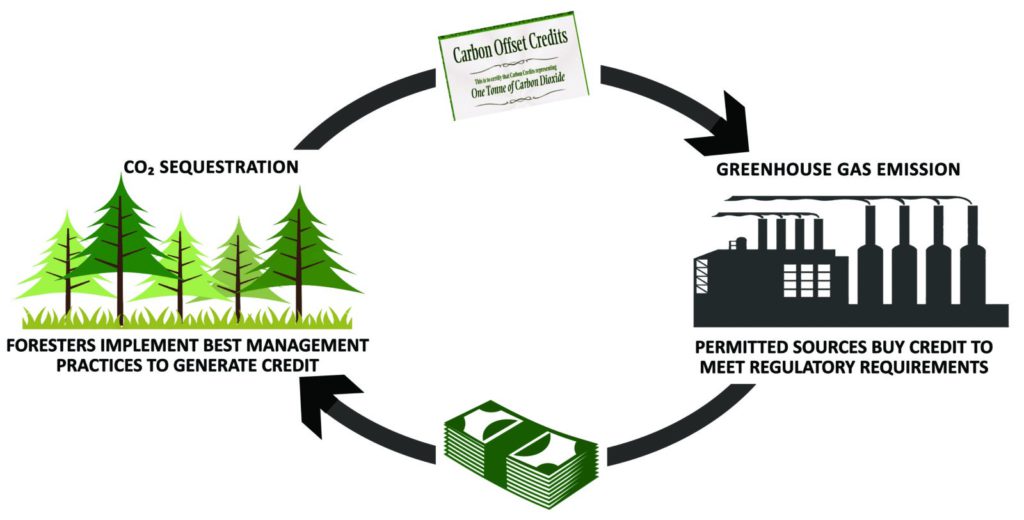

When you buy a coin, you buy carbon credits. One UPCO2 is equivalent to one year-ton of CO2 pollution.

UPCO2s use REDD+ forestation projects to offset emissions. More specifically, in the rainforests of the world. To value each coin, Uphold backs UPCO2s with Voluntary Carbon Units (VCUs).

Put simply, VCUs are digital certificates issued by international standard agencies like Verra. This process allows certified projects to exchange greenhouse gas (GHG) reductions for convertible carbon credits.

How does UPCO2 impact…

The environment

According to UP Alliance Chairman Matthew Le Merle, “The projects we support through carbon credit purchases prevent deforestation in the Amazon, Congo Basin, and Indonesia as well as other threatened rainforests”.

Le Merle continued, “For a new generation of investors looking for more than mere financial return, UPCO2 offers attractive social, economic, and environmental benefits. At a key moment for climate change, UPCO2 allows people worldwide to do good for the planet and potentially do well for themselves.”

Finance, economics

Unlike regulated credits, voluntary carbon credits last (and maintain option value) forever. They are also backed by dollars and globally verified.

As more people become interested in climate action, digital carbon credit coins will become a productive way to put your wallet to work. Kind of like sustainable investing.

Before the blockchain, carbon credits were exclusively traded in obscure over-the-counter (OTC) markets.

OTCs are decentralized exchanges that engage in primarily bilateral trades. That’s finance-geek for… no college students allowed.

A global standard for carbon

By using VCUs, Uphold and its partners hope to produce a single global price for carbon. A digitally-tradable commodity like carbon, essential for human activity, needs a global standard to achieve widespread adoption.

The democratization of carbon credits isn’t only protecting the rainforest. It can carry an economic impact too. Who knows, it could one day become a lucrative market.

Buuttt for now, carbon credit prices are pretty volatile. This is normal for commodity markets.

Why hasn’t the carbon market profited big yet?

Human carbon emissions doubled between 2008 and 2018. You’d think that would correlate to more carbon credits, right? Well, it hasn’t exactly panned out that way.

The UPA argues that the costly process of certifying Voluntary Carbon Projects has prevented serious market growth and a flattened carbon credit supply.

With the help of blockchain technology, that may change. And we can already see an increase in demand.

A digital carbon credit coin alternative to UPCO2

Looking for another option besides UPCO2? There aren’t many.

Alternatively, you can try MC02. MC02 beat UPCO2 to the market by a few weeks. As of December 2020, they have bought and sold over 900,000 tons of CO2.

It’s definitely worth checking out Moss. But keep in mind they are not available on global exchanges yet. Their website says “coming soon”.

You can purchase Universal Carbon on Uphold’s website. The price of Universal Carbon peaked at around $10.73 and currently sits around $9.83 as of writing this on January 18, 2021.

Should I buy digital carbon credit coins?

Uphold is a quality product with a good cause. I also like what the folks at Moss are doing with MC02. Excited to try it when it’s available in the US.

It’s hard to pinpoint any major setback against digital carbon credit tokens.

However, in the Twitter thread below, someone brought up a good point about transparency and VCUs.

How do we know things like, what % of tokenized offsets will go to project developers?

Uphold’s tie to a sketchy lender

It’s also important to note Uphold’s connection to crypto lender Cred. Cred faces allegations of fraud and went bankrupt in 2020.

Some commenters blame Uphold for its connection to the sketchy lender. After a little digging, I concluded that Uphold is a safe platform caught up in a sticky situation.

Cred worked with many different digital wallets as a third-party app, and Uphold was the first company to terminate its services.

I’d recommend giving each platform a try (once Moss is available).

If you are going to purchase a coin, keep in mind that carbon credit prices are more volatile than traditional asset classes.

Like any investment, be sure to research extensively and avoid risky behavior.

The good thing about trading carbon coins? Carbon credit prices are not speculative (unlike an asset like Bitcoin). The price is relative to the value of VCUs. If the demand for VCUs increases, so will the price of your asset.

For those interested in how larger cryptos like Bitcoin and Ethereum impact the environment, you can check out my piece on green cryptocurrency.

If you are completely clueless about crypto-stuff but want to buy a coin, feel free to email me and I will be happy to show you how.

Disclaimer: This content is for informational and educational purposes only and should not be construed as professional financial advice. Should you need such advice, consult a licensed financial or tax advisor.

No Comments