|

|

Can a green crypto make fintech more sustainable?

Already engulfed in the world of digital currencies, I’m admittedly bias toward the use of decentralized blockchain networks like Bitcoin. In fact, my entire day job depends on the reliability of the Ethereum network. But even I know Bitcoin (and other cryptos) do not come without their faults.

For starters, the mother of cryptocurrency requires a lot of energy.

Busy? Try the speed read.

The scoop: Earlier this month, Ripple’s CEO made an ambitious commitment to go carbon net-zero by 2030 in collaboration with conservation Rocky Mountain Institute and REBA, and pressured other crypto companies to do the same.

Talking points:

- Unlike Bitcoin, Ripple (XRP) was built with a finite supply (100 billion) at its inception, making it easier to control mining activities and mitigate its environmental footprint.

- Compared to Bitcoin’s 4.51 billion lightbulb hours needed to mine it, a green crypto like the XRP Ledger uses just 79,000.

- A lot needs to happen to make do on that claim, but Ripple is the first crypto looking to go carbon net-zero, and they have a plan (see below).

Bottom line: I don’t know if Ripple, Ethereum, and Bitcoin will one day replace Euros, Dollars and Yuan. With that said, why not bet a dollar on the possibility that they one day could?

Dig deeper → 3 min

Even digital coins need fossil fuels

Yes, historically (it’s weird to use ‘historic’ in the context of cryptos, but then again Bitcoin is just about the same age as any mainstream social media), Bitcoin has been criticized for its high energy output.

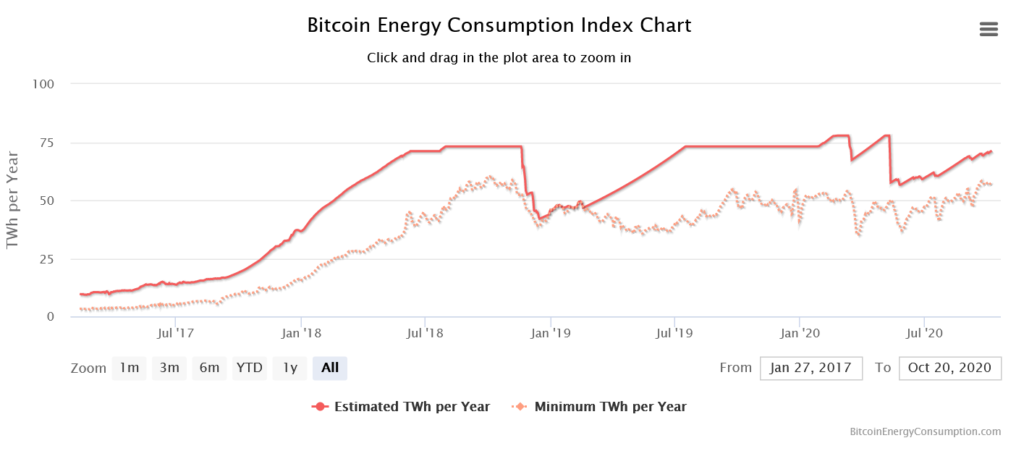

With prices (somewhat) stable, Bitcoin-mining has become a reliable source of revenue. Like any functioning capitalist, coin miners are building the most powerful data centers to get larger pieces of the pie. And many of those data centers depend on some good ole’ fashioned fossil fuels.

The result? You can put two and two together. The entire Bitcoin network now consumes more energy than some countries.

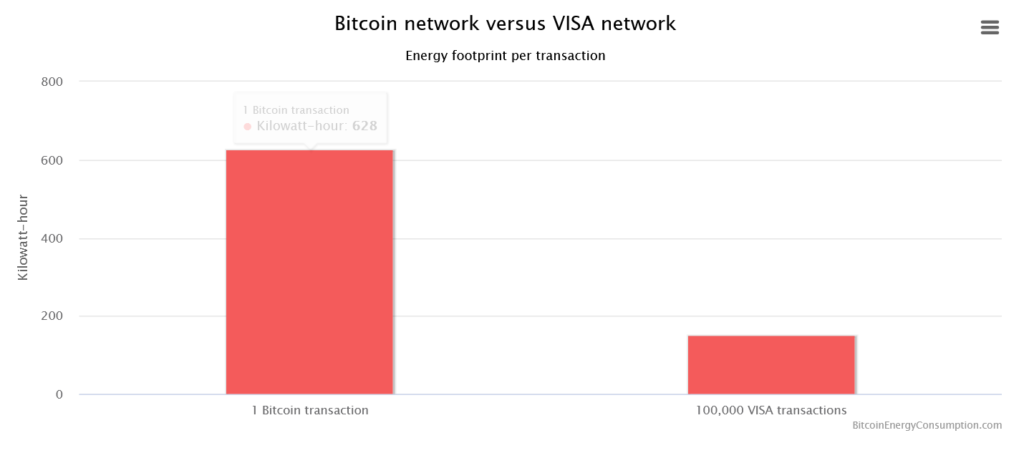

The below chart compares the energy footprint of one bitcoin transaction versus 100,000 visa transactions. Keep in mind that the energy output of Visa offices is not factored into this metric, making the comparison far from perfect, but it does provide a point of reference for how much energy is required to mine coins and transact them.

If you want to learn more about Bitcoin’s footprint versus Visa’s, you can read Hackernoon’s criticism of the comparison. I think they did a good job explaining it.

Team crypto or not, the reality is Bitcoin’s energy consumption is at or around peak levels. Price targets are sturdy. Bitcoin has a promising outlook from credible investors. Bloomberg Intelligence thinks it could reach $100K by 2025. As it becomes more enticing, Bitcoin miners will pump out more coins while they can and environmental considerations will be sidelined.

The good news? There are more sustainable options. Not all cryptos use the same process.

Can Ripple change the energy game for fintech?

OK, so Bitcoin consumes a lot of energy, and crypto is here to stay. So what can a Nature-lover do?

Well, there happens to be many other crypto, non-fiat currencies on the market. One of which is Ripple (XRP). And compared to Bitcoin’s 4.51 billion lightbulb hours needed to mine it, the XRP Ledger uses just 79,000.

As BlockchainTechnology puts it,

Running a single XRP Ledger server is comparable to running a small email server and yet still has the means to power global payment transactions.

That’s powerful stuff. And global banks are paying attention. The global banking industry consumes an estimated 100 terawatt-hours annually, and if digital payment alternatives play the green card, a cute market opportunity can quickly turn into a threat. They know that.

Green crypto to be led by Ripple

Earlier this month, Ripple’s CEO made an ambitious commitment to go carbon net-zero by 2030 in collaboration with conservation Rocky Mountain Institute and REBA, and pressured other crypto companies to do the same. A lot needs to happen to make do on that claim, but Ripple is looking to achieve three primary goals by 2030:

- Comprehensively measure and reduce its carbon footprint, and buy clean, renewable energy in markets where Ripple has offices and employees

- Fund innovative carbon removal technology, with the goal of removing all remaining emissions

- Expand partnerships with innovative conservation organizations and academia

As I write this, XRP is priced at $0.25. Unlike Bitcoin, Ripple was built with a finite supply (100 billion) at its inception, making it easier to control mining activities and mitigate its environmental footprint. I think Ripple can lead the green crypto space and turn fintech into a catalyst for renewable energy.

I don’t know if Ripple, Ethereum, and Bitcoin will one day replace Euros, Dollars and Yuan. With that said, why not bet a dollar on the possibility that they one day could? *

- Disclaimer: This content is for informational and educational purposes only and should not be construed as professional financial advice. Should you need such advice, consult a licensed financial or tax advisor.

No Comments